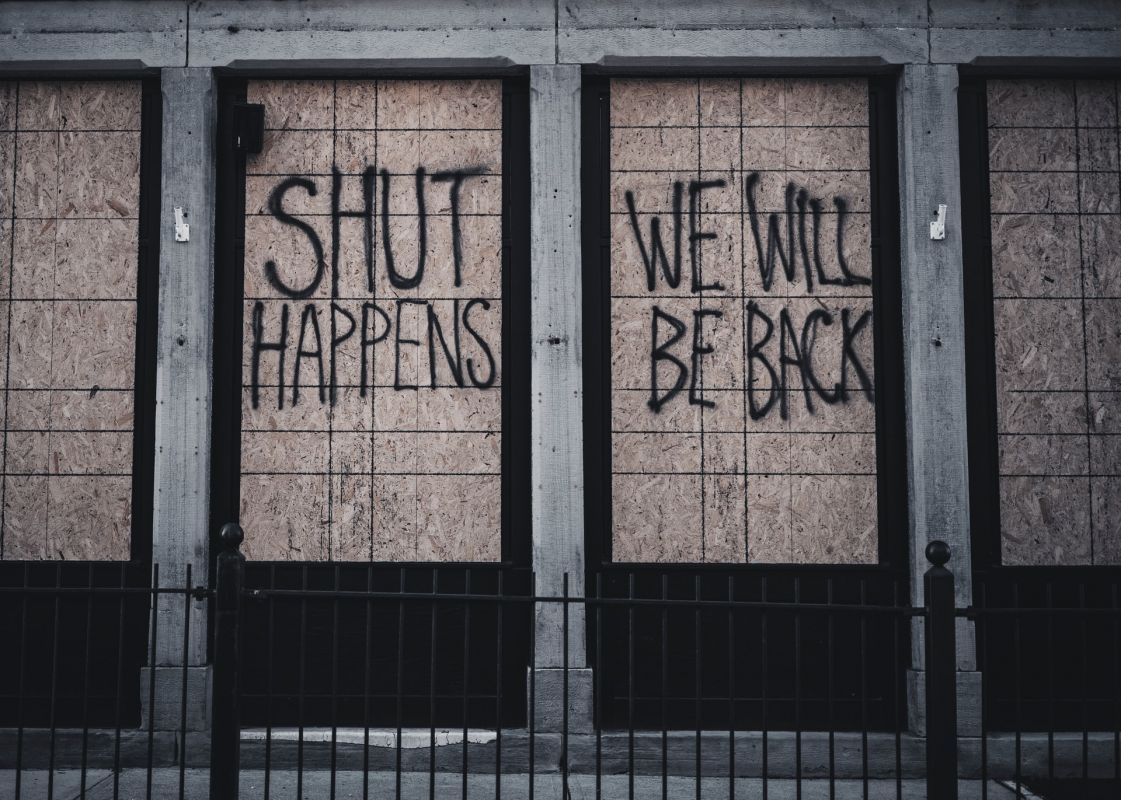

On March 23 the Ontario government announced all non-essential businesses would have to close their physical workplaces effective March 24 2020 at 11:59. Since then, most businesses have suffered losses caused by business interruption due to the shutdown, staff falling ill, or loss of customers or suppliers.

Due to the loss of income, many businesses are filing business interruption insurance (BI) claims. BI coverage is typically an add-on to an existing business insurance policy. In the event of a business temporarily needing to shut down, BI covers continuing expenses or replaces lost profits. However, at the moment most businesses in Canada are not covered for the interruptions caused by COVID.

BI insurance is often part of a commercial property policy, and physical damage to insured property is typically required to trigger coverage, like a damaged building, equipment or stock. That means most business interruption insurance policies do not offer coverage for interruptions due to a pandemic. As a result, small business owners throughout the country and across the world are grappling with denied claims that are collectively worth billions of dollars.

To many denying coverage on the basis of COVID-19 not causing physical damage is unfair, and a number of responses to insurance companies denials for BI claims are appearing. The most prominent responses are lawsuits. In Canada, the US, and many other countries, the number of lawsuits against insurance companies are increasing rapidly. In Canada, the law firm Merchant-Law has started collecting names for a class action lawsuit again more than a dozen insurers in Canada. The Ontario Association of Optometrists took another approach by starting a petition urging their insurers to approve claims resulting from COVID. Governments have been urged to take action as well. In the US politicians are proposing legislation to force insurance companies to pay. Canada has not seen such government interference yet, but it would not be unprecedented to see in the near future. After the Fort McMurray wildfire in 2016 the Albertan government urged the insurance industry to extend the time that insured had to file claims against them. The government threatened to amend legislation to ensure residents were being treated fairly if the insurance company did not comply.

On the other hand, insurance companies are concerned themselves. Every insurance policy is unique, but the principle is the same: the premiums of many are paying for the losses of the few. The 2016 wildfires in Fort McMurray were the priciest insurance claims in Canadian history, but only impacted people in Northern Alberta so insurance customers in other part of the country had their premiums used to help pay for losses in Fort McMurray. However, in the case of COVID-19 everyone is affected. Insurance companies warn that the entire industry could be crippled if they are forced to pay BI claims.

Much of this battle, whether between an insurer and the insured, in court, or in government, will come down to terminology. Whether coverage is available will depend on the wording of the policy, and there are many different wordings sold in the Canadian marketplace. The notion of “physical” damage is likely the most straightforward target: does COVID-19 cause physical damage? It is airborne, but it also rests on physical surfaces. Even if it does constitute physical damage, only some policies cover “potential” physical damage, which could mean proprietors would have to demonstrate that COVID-19 was present at their establishment. Other terms that will be the focus of debate are what qualifies as “named peril”, or what constitutes “loss.” Some insurance companies are also claiming the pandemic was a “force majeure,” which refers to unexpected external circumstances that prevent a party to a contract from meeting their obligations. These examples are just a few questions that will engross the time of lawyers and politicians across the world for the foreseeable future.

For those who find themselves making a BI claim, but do not want to become embattled in a litigious war, there are alternative options, like alternative dispute resolution (ADR). ADR denotes a wide range of dispute resolution processes and techniques that act as a means for disagreeing parties to come to an agreement short of litigation; the most common are mediation and arbitration. Mediation is a negotiation between two or more parties facilitated by a third-party neutral known as the mediator, and is particularly beneficial in the BI insurance debacle for a number of reasons. First, it keeps the process and solutions in the hands of the parties involved. Unlike arbitration or litigation where parties make their case and wait for a ruling that they hope goes their way, mediation allows parties to find a mutually agreed upon solution together. This is specifically promising with BI because neither the insurer nor the insured know which side the lawsuits or government action may support, so there is motivation for both sides to collaborate. Second, mediation is time efficient. Big civil cases and government decisions will take time that many people don’t have, and again, it is unclear who will benefit from the results. Mediation can potentially find a solution anywhere between a day to a few months, allowing both sides to recover more quickly if the mediation is successful. Third, mediation is voluntary and non-binding. If the process is not working, you can leave; but if it works, you can find a very comprehensive settlement.

The economic pressure applied by COVID-19 on small businesses and insurance companies alike is unprecedented, and the lawsuits and government interventions could take a long time to conclude or come into effect. When faced with a BI dispute, mediation is a good alternative to litigation; both parties have control over the solution, its time efficient, and its voluntary.